In Asia, digital banking has been flourishing in recent years due to the increasing demand for online and mobile alternative solutions, coupled with proactive regulatory frameworks. However, the current macroeconomic environment faces rising inflation and the looming global economic downturn, elevating the cost of capital and making investors more cautious in their investment decisions.

Stakeholders in the industry reveal that, amid dwindling venture capital and escalating economic instability, CEOs and leaders of digital banks in Asia are shifting their focus from “growth at all costs” to “achieving profitability.”

During a discussion at the Elevandi Insights Forum at the Singapore Fintech Festival 2022, CEOs of leading digital banks in Asia, along with experts from management consulting firm Oliver Wyman (USA), deliberated on the state of the digital banking sector in the region. They explored current growth opportunities as well as future-shaping risks.

1. Lending Takes Center Stage in Digital Banking Profitability

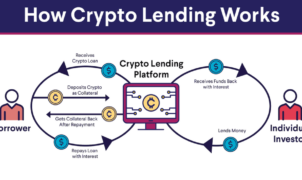

The first highlighted theme is that digital banks need to concentrate on profitability. Startups are navigating an exceptionally challenging environment with increasing inflation and political instability. Investors are more cautious in deploying funding, fearing the uncertain economic landscape, declining tech stock prices, and escalating economic concerns.In this context, founders are shifting focus from rapid growth to profitability. While expanding reach to the unbanked and underbanked remains a primary motivation for traction, lending activities have proven to be a “secret sauce” for a successful and profitable strategy.However, experts caution that to fully exploit the potential of lending activities, digital banks need to overcome challenges related to serving the unbanked population, who often lack the necessary traditional data points for lending decisions. Some providers have addressed this by integrating alternative data sources from ecosystem partners, such as telecom companies, to secure loans. Combining this alternative data with detailed customer information enables digital banks to better price the lending risk, making lending decisions more insightful.

2. Open Technology Architecture Trends

The second theme emphasizes the need for open technology architecture trends. This architecture allows quick experimentation and the launch of new products, as well as secure data sharing within the ecosystem.With a suitable platform architecture, digital banks can derive various benefits. They can use data from ecosystem partners, such as telecom companies and e-wallets, to develop highly personalized products and services, as well as guarantee loans.Furthermore, an open architecture enables digital banks to expand service distribution channels by activating models like embedded finance and Banking as a Service (BaaS). For example, a digital bank can embed its APIs into the customer journey of an ecosystem partner to offer products such as loans and Buy Now Pay Later (BNPL) deals.

3. Open and Trustworthy Data

The third trend highlighted is the need for digital banks to leverage open and trustworthy utilities, such as national identification databases.Experts note that these digital utilities provide access, payment capabilities, and the reliability of banking services, enabling digital banks to streamline processes such as onboarding and loan approval.Digital identification programs like Singapore’s Singpass support electronic Know Your Customer (eKYC), allowing digital banks to remotely verify a person’s identity. Digital utilities also enable banks to use external data from other financial entities, such as credit bureaus and other banks, to assess lending risks for individual customers, rationalizing the loan approval process.Ultimately, this helps improve risk management, achieve efficiency, reduce service costs, and enable greater access to banking services for the unbanked.

4. Human Capital as the Key Motivator for Success

Attracting talent is currently one of the major challenges facing Asian banks. In this context, business leaders agree that they must focus on key areas in the future.Firstly, groups need to build and maintain a suitable working culture, ensuring that new hires truly align with the corporate culture. Experts highlight that developing and sustaining this culture will be crucial for attracting and retaining suitable talent.Banks should also eliminate traditional basic compensation plans and implement performance-related plans, such as stock options. This will not only boost performance but also attract confident candidates who believe in their ability to build a next-generation organization.Finally, business leaders need to provide a conducive environment for employees to learn, develop, and feel empowered, aligning with core employer propositions to attract a flexible target talent pool based on employees’ interests.

5. Favorable Legal Environment

Last but not least, the regulatory bodies will continue to play a crucial role in the development of the digital banking industry. While efforts have been made to create conditions for industry growth in Asia, more is still needed.During the conference, prominent initiatives such as the shift from rule-based to risk-based approaches for KYC, as well as various digital banking frameworks implemented across the region, were discussed.Investors and businesses also expressed hopes for future regulatory frameworks. Key areas include the use of sandbox environments to test innovative types of innovation alongside regulatory bodies, expanding infrastructure, cross-border collaboration efforts, and the development of initiatives to create favorable conditions for a level playing field between digital banks and traditional banks.

Cre: tinnhanhchungkhoan